The trials and tribulations of the economy, business and personal life has taken many turns over the past two and a half years. It has been one of the most challenging periods for businesses and individuals to navigate through.

But what are the current top concerns of CFO’s and Credit Managers and what keeps them up at night?

After surveying hundreds of our clients, they have given NCI an insight into their top 3 concerns for 2022.

Sourcing materials/ increase in costs of goods.

Anyone who’s building a house will no doubt know the pains of supply delays and increasing raw material costs!

In a recent case someone waited an additional 8 months beyond their original completion date and had variations of over $50,000 to complete their build. But the building industry is not the only sector experiencing increases in costs. Food, services, and energy costs have hit the hip-pocket of individuals and increased the expenses on businesses’ P&L.

This naturally leads to higher overall costs and end product increases to the consumer.

Labour shortages

Everyone has a story of needing to quickly rebuild or replace positions post the pandemic. The disruptions to the business environment in many sectors led to layoffs or redirection of labour throughout 2020 and 2021.

Look at the challenges facing the travel sector in trying to quickly replace labour to deal with the current and future demands.

Labour shortages also bring a lack of skills in specialist sectors and industries, placing pressure on existing wages and acquisition of new labour.

Many businesses are having higher than ‘normal’ levels of staff changes which compounds to recruitment, training and workflow pressures.

Overdue debts/customer non payment

21% of survey respondents highlighted their concerns about increasing overdue debts and non-payments from their customers.

This is a trend which many economists predict will increase further over the next year. Businesses have experienced extremely low insolvency rates and, with government incentives through the pandemic, businesses seemed to be flush with cash.

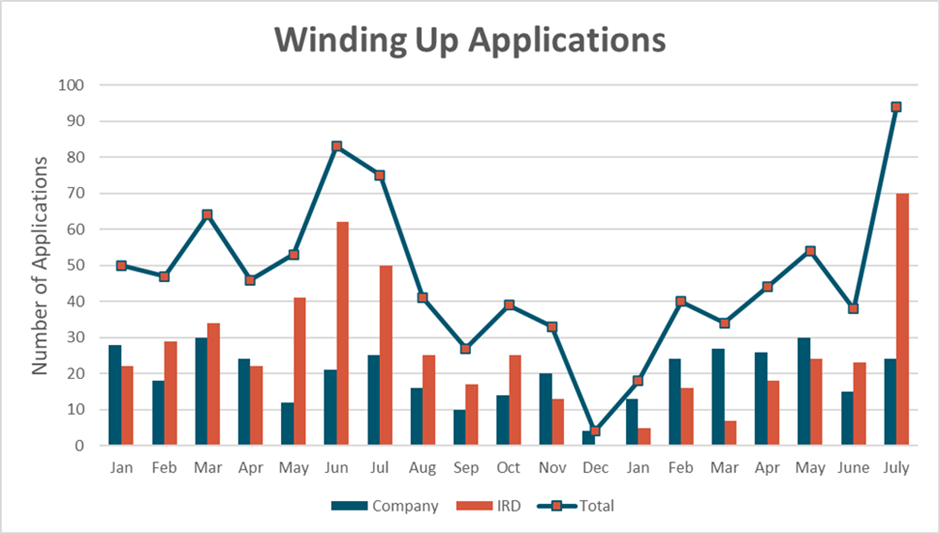

July 2022 saw the IRD initiated wind up applications triple, with serious pressure now back on debtors to pay overdue tax liabilities. IRD debt levels have doubled since the beginning of 2020 and this could not continue indefinitely.

Graph curtesy of McDonald Vague.

Cashflow issues, rising interest rates and lower predicted sales revenue were other factors which were concerning our clients.

Whilst sourcing materials and costs, as well as transportation factors, are easing, labour shortages and overdue debts seem to be ongoing factors we will all need to deal with.

So where does your business sit on these concerns?

NCI, with our full range of trade credit services, can support businesses in preparing and sleeping better at night, by removing the worry relating to predicting, and protecting yourself against, non-payment or insolvencies. Ask yourself these questions:

When was the last time you conducted a full health check on your customer list?

What was the impact on your customers throughout the pandemic?

Do they have the same level of capital and cashflow to maintain their business in a healthy environment?

NCI’s unique database, and ‘secret intel’ can provide a business with early warning signs specific to your customer list. We alert you to those customers who may not be in a position to pay into the future and allow you to make early changes to avoid non- payment and bad debts into the future.